Welcome To be happy financial

The "how to" for Personal Financial Budgeting & Planning

an important prerequisite to using your preferred financial tracking app

Tools & Resources - Personal Finance Budgets & long term Plans

Our SELF-HELP personal finance guides and tutorials enable a deep understanding of your financial situation, to help you gain financial stability, predictability, and peace of mind.

We are an ethical website – we do not sell your information to 3rd parties, and the guides have been developed to genuinely help gain financial stability.

Make this a life changing moment for you...

Our animated videos guide you to understanding your financial situation more deeply.

We believe this to be an important pre-requisite to using online mobile apps to monitor and track your spending.

If one or more of the following applies to you, then we strongly recommend

to watch our free animated guides below or paid tutorials (lifetime access) in the Tutorials page.

- Are you living one pay check to the next?

- Do you desire to be more financially secure?

- Demoralized through becoming accustomed by life riddled with debt?

- Struggling to manage when unforeseen financial events occur?

- Do not know how to balance your finances and save more money?

- Experienced an event that has shaken you financially?

Or… you are reasonably secure financially, but simply want to do better?

FREE: Below are the 4 animated guides using simple 'back to basics' techniques to manage personal financial budgeting and planning

Each animated guide is just a few minutes long (short, sweet and simple). Watch them with your family and friends too…..

For more detailed guides, financial budget templates and examples, that will save you time and effort, please go to our Tutorials page.

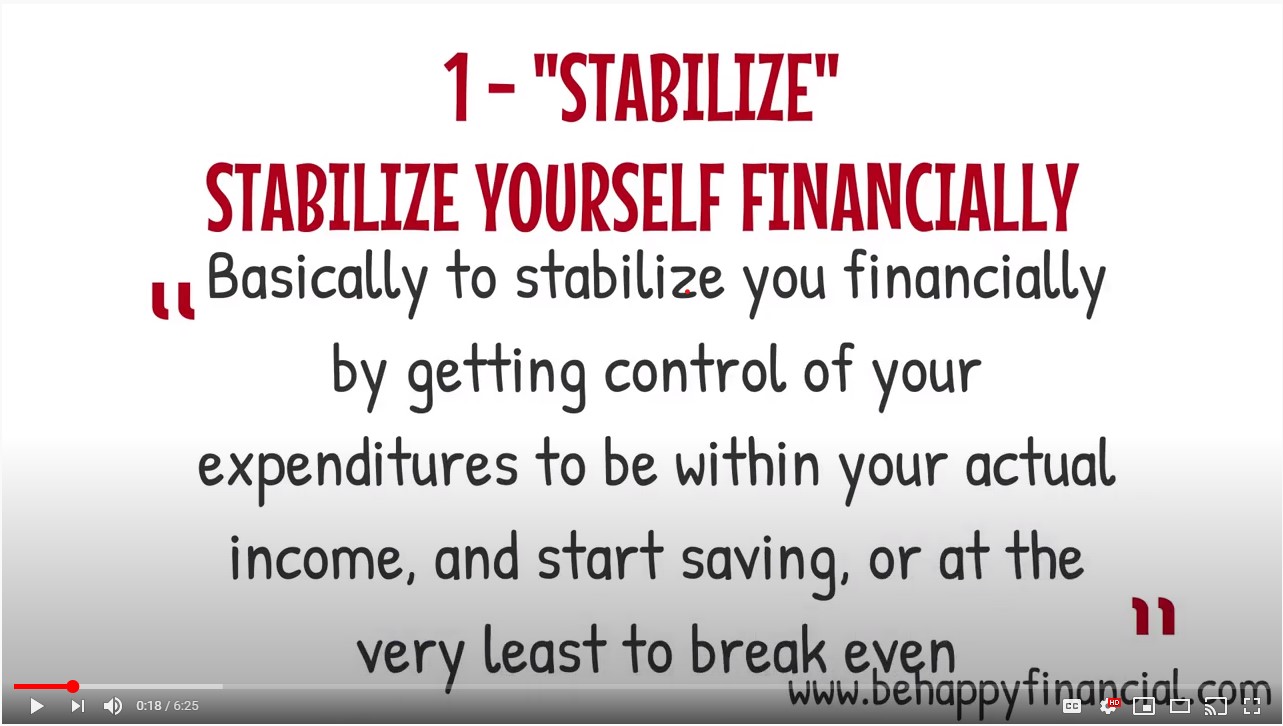

#1

"STABILIZE"

Stabilize Yourself Financially

We share our methods to take control of your finances by getting to know your income and expenditure

#2

"AMEND"

Deeply Assess & Amend Spending Behaviors

Amend your spending behaviors using the tools in STABILIZE. You will have identified how to rationalize your expenditures and maybe even discovered that your expenditures are significantly more than you perceived – time to now amend your behaviors.

#3

"FOCUS"

Identify & Know How to Achieve Your Financial Goals

Having amended your spending behaviors, let’s identify your longer term financial goals and set about learning how to achieve them.

#4

"INSPIRATION!"

Increase My Income

Want more than your current goals? Time to look at leveraging your strengths to raise your goals and achieve what you really desire.

Tutorials

($2.50 Lifetime Subscription)

For just $2.50, we provide step-by-step guides on the specific techniques referenced in the free animated guides (1 to 3), plus we provide templates and examples to make it easier for you, and time saving!

Click on the Tutorials Login button and payment can be safely made by bank or credit card (we do not accept PayPal at this time).

Online Mobile Apps

In the ‘Useful Apps’ page, we provide a list of online mobile apps that offer personal finance tracking tools and often much more.

These are not the same as our tutorials. Instead we focus on realizing your financial situation and bringing it under control. This will help you when using an online app.