A Few Words

About Us

"We can help, and we want to help."

This site was conceived to address exactly that

We sincerely hope the information in this site is useful and for those needing help with financial management, that this is a life changing moment for you.

We are big advocates of spending and contributing to a healthy economy, but also big advocates that individuals and families do this responsibly and not to go beyond their means.

Much of the following is already lightly covered in the Home page, but for those wanting a deeper understanding of achieving financial stability and freedom, then this is a worthwhile read.

Globally and domestically people struggle with their personal financial management

Globally and domestically, there are a staggering number of individuals and families who either do not have a savings account or enough money saved to sustain themselves or their families in the event of an adverse situation, for example and most recently COVID-19.

We would like to help and share with you our methods that could potentially result in more control of your personal finances. We also want to raise awareness of ‘expense stacking’ which is quantifying frequent minor expenses (often unnecessary) and how the frequency of those expenses ‘stacks up’ over a year into a significant amount of money.

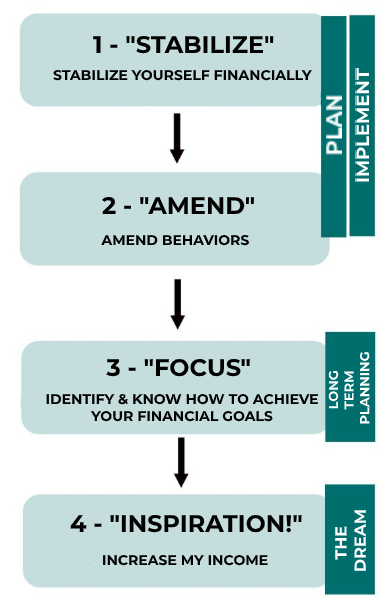

In the first guide, we offer high-level guidance on how to better PLAN your personal finances. For example using basic techniques to identify every single type of expense that you can incur, and then setting about making budget allocations for them. Using Microsoft Excel, or even just pencil and paper, one can create a budget (we call this a financial assessment) and using various information sources to ensure it is accurate and fully encompassing.

Once you have understood your personal financial situation, and have reflected this on a document budget sheet, or financial assessment (as we call it), the second guide then talks about the need to assess your expenditures more deeply and where necessary amend spending behaviors.

In addition to planning and implementing a new regime for your financial management, the third guide talks about our methods on how to identify and set about achieving your ultimate financial goals. Essentially, this is disconnecting on what you perceive as financially possible as of today, and instead looking at where you really want to be financially in the future – what kind of home do you want, what amount of savings do you want, retirement hopes and so on, and knowing what opportunities exist for you to achieve them.

This naturally leads to the 4th guide and this is essentially thinking outside of the box but more inspirationally – what skills and opportunities do you have to find alternative ways to increase or generate a new income. This is not guidance and instead sharing some useful information on how to perform this as an exercise.